More than 80% of Kazakhstanis reported increased spending on food and essential goods throughout 2025.

DEMOSCOPE Express Public Opinion Monitoring Bureau presents the results of surveys conducted in March, August, and November 2025. The study examined the following indicators: household expenditures, citizens’ financial well-being, and the effectiveness of the government’s socio-economic measures. The project is implemented by MediaNet International Center for Journalism in cooperation with PAPERLAB Research Center and with the support of Konrad Adenauer Foundation.

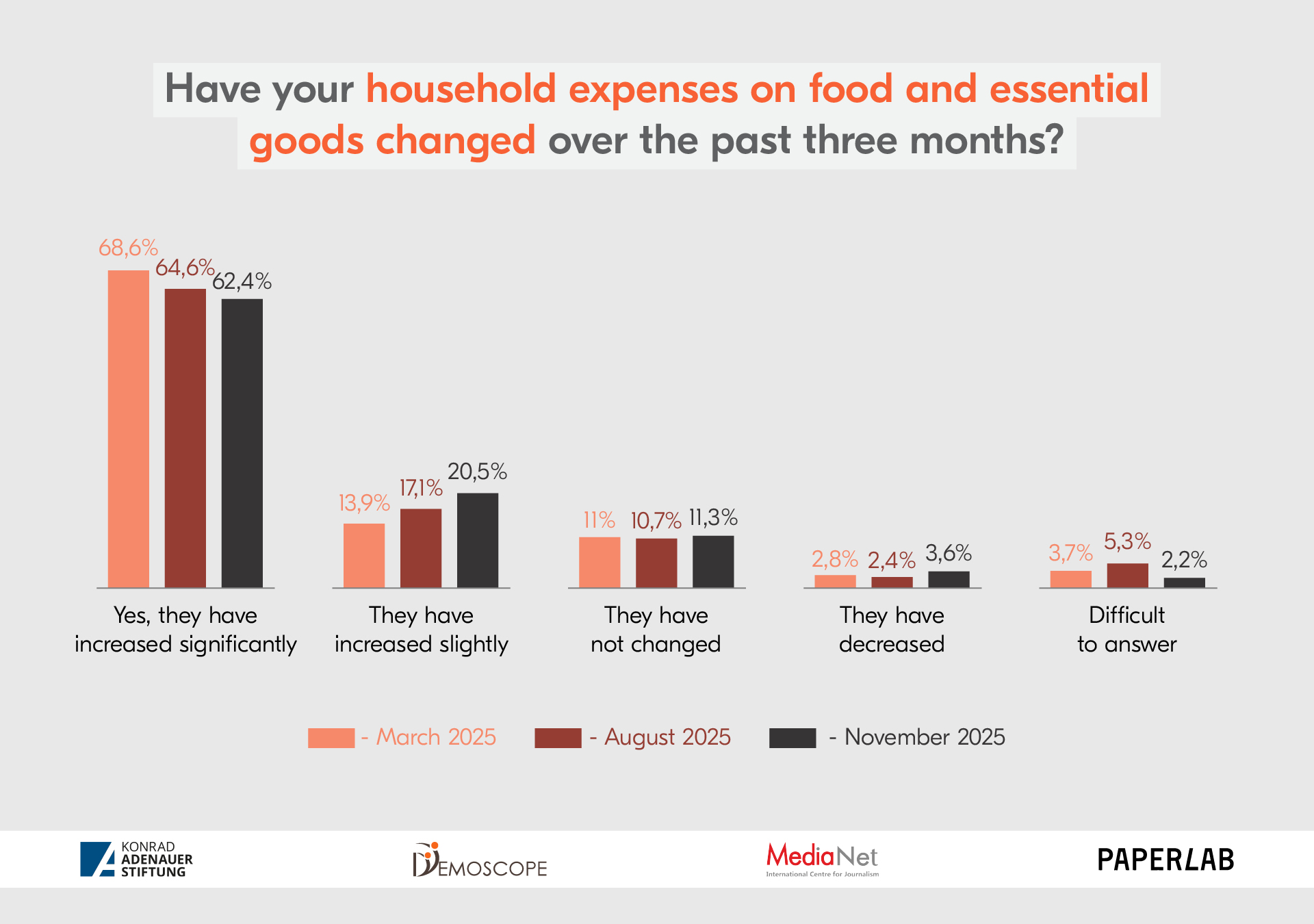

Household Expenditures

According to the DEMOSCOPE measurements, more than 80% of survey respondents reported an increase in spending on food and essential goods over the course of 2025. When viewed dynamically, the data show only minimal variation, indicating weak public adaptation to inflation. The highest share was recorded in March, when 68.6% of respondents reported a significant increase in expenses. In August, this figure stood at 64.6%, and in November at 62.4%.

At the same time, the proportion of respondents who also noted an increase in spending – albeit a minor one – grew from 13.9% in August to 20.5% in November. Overall, nearly 82% of respondents throughout 2025 reported higher spending on food and essential goods. On average, only 11% said their expenses remained unchanged, while a very small share reported a decrease.

The DEMOSCOPE survey data correlate with the conclusions of analysts at Halyk Finance, who report that the real incomes of Kazakhstanis declined by 3.4% year-on-year. The main contributing factors were high inflation and the depreciation of the national currency, both of which continued to exert pressure on the population’s purchasing power. At the same time, according to preliminary data from the Bureau of National Statistics, Kazakhstan’s GDP growth reached 6.5% in January–December 2025.

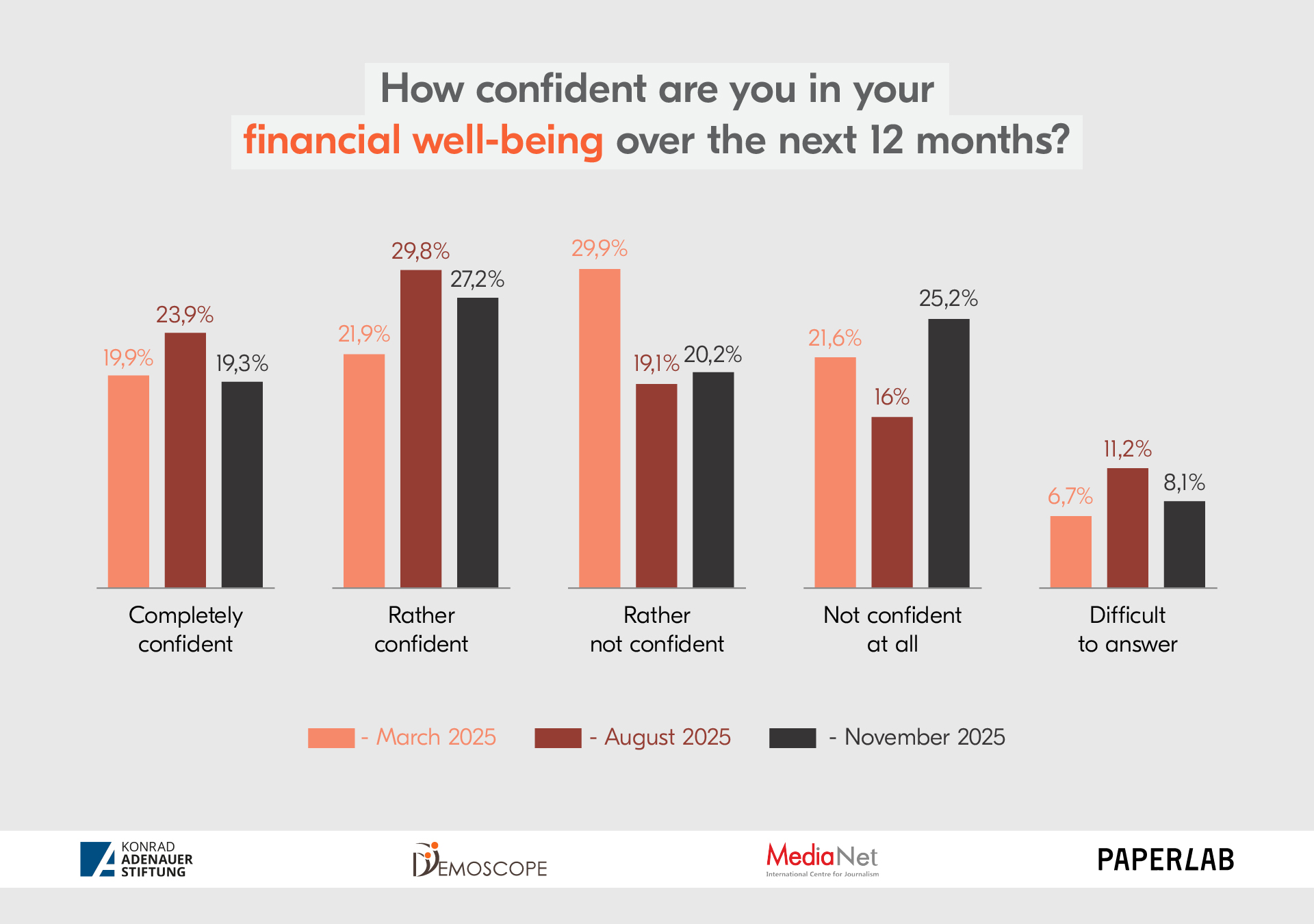

Citizens’ Financial Well-Being

Another key indicator of public sentiment is citizens’ assessment of their own financial well-being. In each of the three survey waves, respondents were asked how confident they were about their financial situation over the next 12 months. Notably, the most anxious public sentiment was recorded in March 2025, coinciding with the period of the highest level of distrust in the government. According to DEMOSCOPE, a total of 51.5% of respondents were not confident in their financial stability: one-third (29.9%) reported being rather unconfident, while one-fifth (21.6%) said they were not confident at all.

By August, the situation regarding financial well-being had somewhat stabilized. The survey recorded a significant decrease in the share of those who were rather unconfident – from 29.9% in March to 19.1% in August – as well as a decline in those who were completely unconfident, from 21.6% in March to 16% in August. This outcome may be partly explained by seasonal factors, including the abundance of fresh and more affordable fruits and vegetables, which in turn reduced overall spending on food.

However, by November the survey again recorded a rise in financial anxiety among citizens: 20.2% reported being rather unconfident, and 25.2% said they were completely unconfident in their economic stability. At the same time, a total of 41.8% in March, 53.7% in August, and 46.5% in November expressed confidence in their financial well-being over the next 12 months – some fully confident, others rather confident.

Trust in the Government

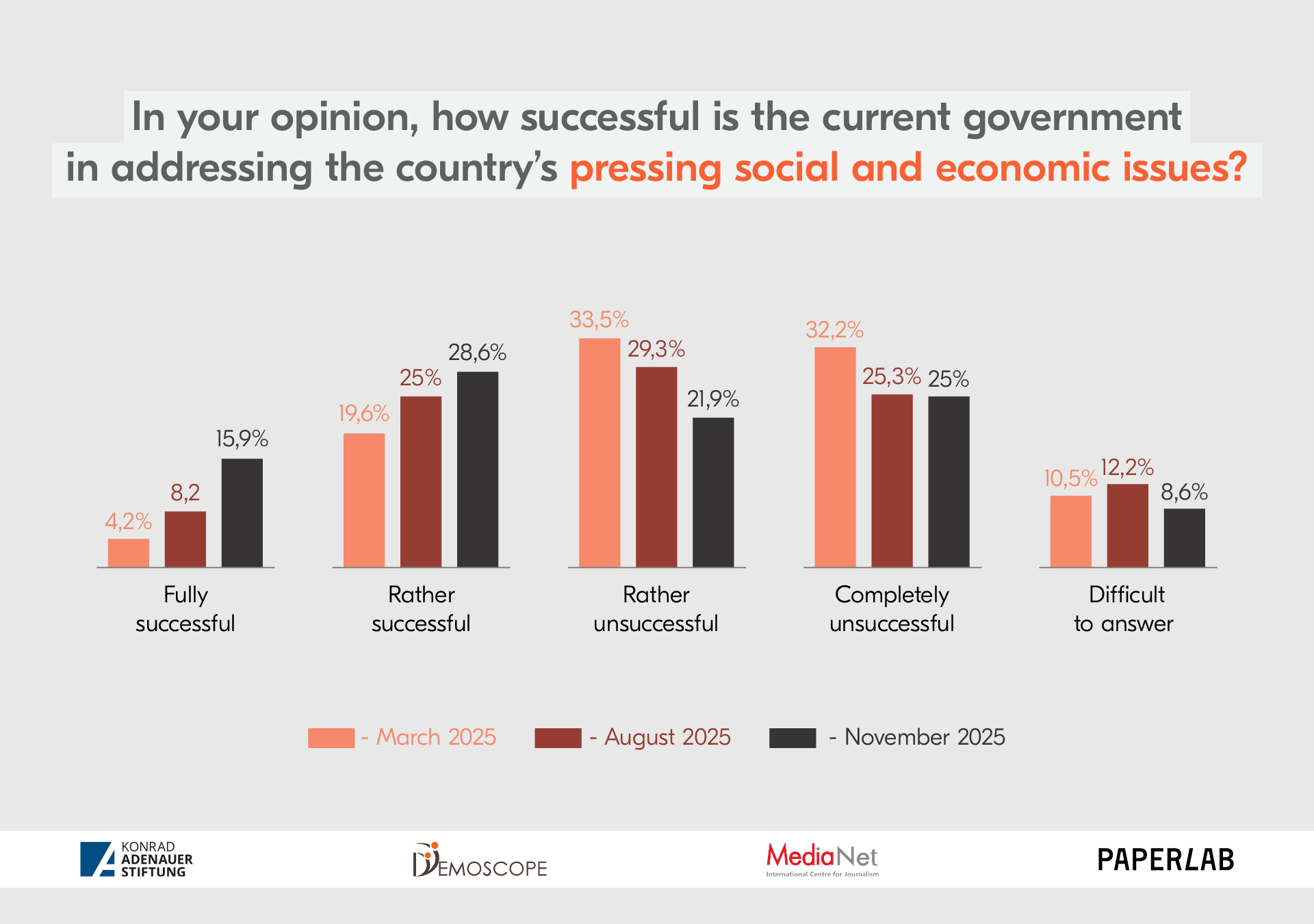

Perhaps the most important indicator in the DEMOSCOPE study is citizens’ assessment of how effectively the Government of Kazakhstan is addressing pressing socio-economic challenges.

In March, the survey recorded a peak in public distrust toward the government, with the combined share of negative assessments reaching 65.7%. One-third of respondents (33.5%) stated that the authorities were rather ineffective, while another third (32.2%) said the government was completely ineffective in dealing with current issues.

By August, criticism of the government had somewhat eased, primarily due to a reduction in the share of respondents who selected the most severe assessment – “completely ineffective” – which fell from 32.2% in March to 25.3% in August. The proportion of those who believed the authorities were rather ineffective also declined, from 33.5% to 29.3%. By November, this trend continued, with a further decrease in the share of respondents who felt the authorities were rather ineffective – from 29.3% to 21.9%. The proportion of respondents who stated that the government was “completely ineffective” remained unchanged at 25%.

Overall, negative assessments declined over the year as public trust increased. The share of respondents who evaluated the government’s performance positively amounted to 23.8% in March, rose to 33.2% in August, and reached 44.6% by November. This growth was observed both among those expressing full confidence in the authorities and among those offering a more moderate but still positive assessment of the executive branch’s performance.

The results of the three DEMOSCOPE survey waves demonstrate that the ongoing economic crisis is exacerbating the financial well-being of Kazakhstanis, which in turn is reflected in declining trust in the government. This trend was particularly evident in March 2025, when 68.6% of citizens reported a significant increase in spending on essential goods, while at the same time 65.7% of respondents stated that the government was failing to effectively address socio-economic challenges.

Given the increase in the VAT rate from 12% to 16% and other tax changes planned for 2026, the economic burden on households is expected to rise further. It is worth recalling that, according to another DEMOSCOPE survey conducted at the end of 2025, a majority of Kazakhstanis (61.4%) were convinced that higher taxes would inevitably lead to rising prices and negatively affect their quality of life.

Detailed survey results are available on the project website. The press release and infographics in Kazakh and Russian can be accessed via the link provided. When using these materials, a hyperlink to the DEMOSCOPE website is mandatory.

Methodology: The data were collected across three survey waves conducted on March 20–31, August 28–September 10, and November 25–December 5, 2025. Each survey wave included 1,100 respondents across 17 regions and cities of national significance (Astana, Almaty, and Shymkent). The surveys were carried out via telephone interviews among mobile phone subscribers in Kazakhstan. The sample was based on a database of phone numbers generated using a random number generator. Telephone interviewing was conducted by KT CloudLab Contact Center. The surveys were administered in Kazakh and Russian among respondents aged 18 and older, residing in both urban and rural areas. The data were weighted by key demographic parameters, including respondents’ gender and age. With a 95% confidence level, the maximum margin of error does not exceed 3%. The response rate ranged from 19.1% to 10%, depending on the survey wave. The survey was implemented by MediaNet International Center for Journalism Public Foundation with the support of Konrad Adenauer Foundation. The survey data reflect the views of the respondents. For additional information, please contact the project coordinator, Snezhana Tsoy, at snezhana.tsoy@medianet.ngo.